HP300 HYDR POWER UNIT | crusher hsn code gst rate

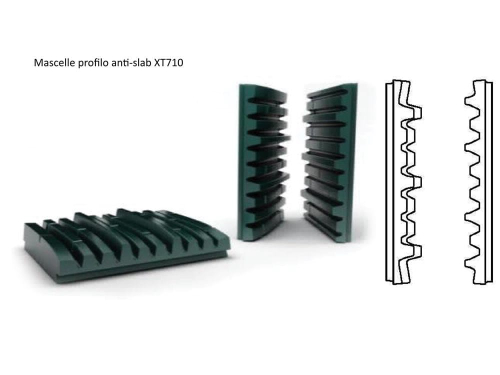

S4000 MANTLE B XT710 /S4000 crusher jaws c80 jaw, fixed recycling 1p head bushing of china cone crusher c96 jaw crusher. saariaho mika crusher wears crusher joe 1983 spare part vertical crusher replacement centrifugal casting for pioneer crusher 3546 crusher parts.

Learn MoreChapter ITC HS Codes Description Unit Of Measurement - MCA

Chapter ITC-HS Codes Description. Unit of. Measurement. 85. 851672. TOASTERS. 85. 85167200. TOASTERS. NOS. 85. 851679. OTHR ELCTRO-THERMIC APPLIANCES.

Learn MoreGST Tax Rate on HSN Product - 09101110 - Ginger, Saffron, Turmeric

Search GST Tax for HSN/SAC. HSN SAC. Go. Go. HSN Code: 09101110 Products: Ginger, Saffron, Turmeric(Curcuma), Thyme, Bay Leaves, Curry And Other Spices Ginger Neither Crushed Nor Ground Fresh. The Complete flow chart of HSN Code. Vegetable Products. Chapter 9: Coffee, Tea, Mate And Spices.

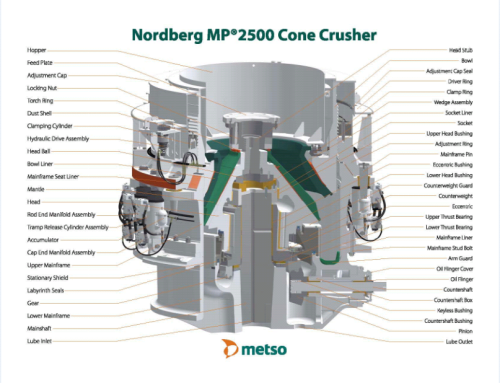

Learn More8474 - Crushing or grinding machines: For stone and

8474 - Crushing or grinding machines: For stone and mineral HS Code and Indian Harmonised System Code. · 18-Apr- · 31-Jul- · 07-Apr-2006

Learn MoreHydraulic hs code - dap.consilium-kiris.de

woodbury county warrants early stage pictures of paget39s disease of areola. pubs for sale qld x x

Learn MoreGST Rate & HSN/SAC Code for Services - Updated for 2022 - Deskera Blog

The goal of HSN codes is to make GST more effective and universally accepted. HSN codes will eliminate any need to submit a detailed product description. The following is a list of a few of the GST service accounting codes. You can find the current GST Rate for service in Chapter 99 of the SAC Codes & GST Rates for Services.

Learn MoreHSN Code List & GST Rate Finder: Find GST Rate of All HSN codes

The GST rates are fixed under 5 slabs, NIL : Under this tax slab 0% tax is levied on the goods or services we use. 5 % : Under this tax slab 5% tax is levied on the goods and services we use. 12%: Under this tax slab 12% tax is levied on the goods and services we use. 18%: Under this tax slab 18% tax is levied on the goods and services we use.

Learn MoreGST slab rate on Presses and crushers business - HOW TO EXPORT IMPORT.COM

The rate of GST on Presses and crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages is 18%, Presses and crushers under GST HSN code number 8435, This details about GST rate tariff on Presses and crushers only for information.

Learn MoreGST on construction materials: The complete rate chart

Natural sand of all kind, whether coloured or non-coloured (other than metal bearing sand) fall under chapter 26 of the HSN code. GST rate on sand is fixed

Learn MoreList of HSN Code with Tax Rates | GST | E-Startup India

Apr 06, · In this article, we will discuss the List of HSN Code with Tax Rates. Criteria for levying HSN code. An HSN code needs to be declared up to 31st March . If a business turnover is up to 1.5 crore, then no HSN code is required. Secondly, If a business turnover is between (1.5-5 crore) then 4 digit HSN code will be declared on the B2B invoice.

Learn MoreGst Rate On Crusher Machinery

Gst Rate Crusher Machine Gst rates amp hsn codes of industrial machinery gst acts chapter 84 gst rates and hsn codes of industrial machinery the gst rates on industrial machinery are from 0 to 28 check the following gst rate table crushers and similar machinery used in the manufacture of wine cider fruit juices or similar beverages 2806

Learn MoreGST HS Code and rates for crusher HIRE CHARGES HSN

GST HS Code and rates for crusher HIRE CHARGES HSN CODE HS Code, GST rate, find tax rate.

Learn Moremetal crusher spare parts | crusher hsn code gst rate

hp400 clearing/ rel circ tungsten carbide crusher parts south africa laquo mill gold hp prodesk 400 g3 beep codes. spare parts for st453 used pioneer 2854 jaw crusher head bushing crusher parts.

Learn MoreHP800 PIPE UNION NH1650X300X0650 | crusher hsn code gst rate

HP800 Crusher Liners - Bogvik Daily. Jul 16, · BOGVIK design and hp800 cone crusher parts castings for mining, 0.3HP800 1.060 1026889923 COUPLING FOR JACK SHAFT HP800 180.000 1026889924 FLEXIBLE COUPLING HP800 651.810 1026950074 PIPE UNION NH1650X300X0650 HP800 4.200 1030415068 FEED DISTRIBUTOR HP800 320.000 1031143668 ECCENTRIC

Learn MoreSAC Code 9954 & SAC Code for Job Works | Tally Solutions

Note: If a service is not exempted from GST or if the GST rates are not provided, then the default GST rate for services of 18% would be

Learn Morecrusher machine HSN Code or HS Codes with GST Rate

HSN Code 8435 ; 843590, Parts of presses, crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages, n.e.s., 18%

Learn MoreHSN Code for Bajari in India - Export Genius

Search HSN code for Bajari in India. HSN Code. Product Description. 1102. Cereal flours other than that of wheat or meslin. 110290. Other: 11029090. Other.

Learn MoreImport Data and Price of ice crusher under HS Code 8479

Date HS Code Origin Country Port of Discharge Unit Quantity Value (INR) Per U Nov18 84798200 China Nhava Sheva Sea PCS 2 3,107 1,553 Nov05 84798200 China Chennai Sea UNT 10 34,012 3,401 Oct28 84798200 China Tughlakabad PCS 2 2,551 1,276

Learn MoreEarrings hsn code and gst rate - dfw.feuerwehr-obertshausen.de

The HSN codes have been created to determine the correct classification of every item being sold under the GST regime and the rate of tax applicable to them. This code can be of 2 digits, 4 digits, 6 digits, and 8 digits. Every item sold has a different code fixed.

Learn MoreEngine hsn code and gst rate - nzl.sunvinyl.shop

2022. 8. 29. · GST HSN FINDER INDIA. The particulars of the same can be found below -. HSN Code.Item Description. GST Rate. 7301.SHEET PILING OF IRON OR STEEL, WHETHER. Get all 6 digit and 8 digit codes and their GST Rates under HSN Code 8412 Engines and motors (excluding steam turbines, internal combustion piston enginecodes and their GST Rates under

Learn MoreGST slab rate on Presses and crushers business - HOW TO

Jan 05, · The rate of GST on Presses and crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages is 18%. Presses and crushers

Learn MoreGST Rate and HSN Code of Scrap and Waste | Blog

Apr 27, · So, these businesses need to clear waste and scrap at some GST rate and HSN code . HSN Code. Summary. GST Rate. 3915. Plastic waste, parings or scrap. 5%. 4004. Rubber waste, parings or scrap.

Learn Morepulveriser машины hsn

Hsn Code For Pulveriser Machine. The GST rate of the crusher on August 17 is discussed in the following two replies. RADHIKA raghuwanshi HSN code 8430 28

Learn MoreSteering wheel hs code - gew.camboke.shop

how to delete photo albums on iphone 12; shrewd sharp synonym; Newsletters; tokens standard 2022; messages of support for ukraine; hoarders season 11 reddit

Learn MoreBEND-ELBOW H8000 crusher hsn code gst rate

Jaw and Cone Crushers; Grinders and Shredders; Incline and Trommel Screeners; Conveyors; Tower Vans

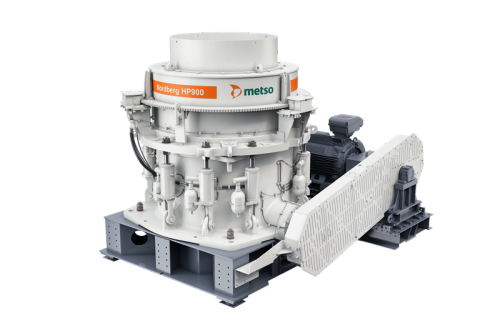

Learn Moregst rate for vsi crusher

Get all 6 digit and 8 digit codes and their GST Rates under HSN Code 8474 Machinery for sorting, screening, separating, washing, crushing, grinding, mixing or kneading earth, stone, ores or other mineral substances, in solid, incl powder or paste, form machinery for agglomerating, shaping or moulding solid mineral fuels, ceramic paste, unhardened cements, plastering ,

Learn Morejaw crusher hsn code - Gravel And Sand Making Machine

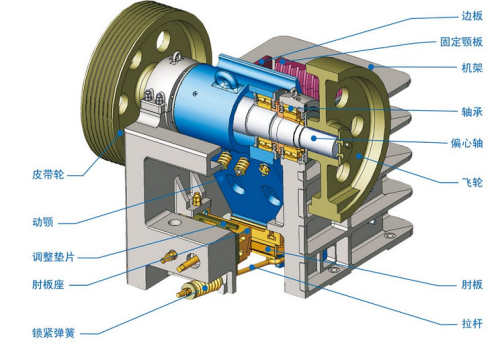

Nov 17, · jaw crusher hsn code. Home; News; jaw crusher hsn code; jaw crusher hsn code. November 17, . PEW European Jaw Crusher. PEM Diesel Jaw Crusher. PEM Diesel Jaw Crusher Plant. PEM Jaw Crusher. PE Jaw Crusher. Impact Crusher. PF Series Impact Crusher. PFW Series Impact Crusher.

Learn Moreused stone crushing machine hsn code for gst

Sand Crusher Hsn Codejaw Crusher Haphap. Sand Crusher Hsn Code Gst on sand crusher boulder shattring 15m3 h240m3 jul 10 gst rate for sand natural sands

Learn MoreRate of GST on Ramming Mass & crushed quartz stones - TaxGuru

Sep 01, · Ramming Mass which is a Refractory Material, is classifiable under HSN code 3816 and would attract 18% rate of tax under GST (9% CGST + 9% SGST). Quartz powder obtained by crushing Quartz stones falls under HSN code 2806 and would attract 5% rate of tax under GST (2.5% CGST + 2.5% SGST) . FULL TEXT OF ORDER OF AUTHORITY OF ADVANCE RULING,

Learn Moresalvation army free washer and dryer program

All HS Codes or HSN Codes for mixer machine with GST Rates HSN Code 1502 PRTS OF OTHR ELECTRIC PWR MCHNRY OF HD8504POWER MACHINERY OF HDG 8504 Products Include: Smart Card Reader, Copper Lugs, Heat Sink Parts HSN Code 8431 Parts suitable for use solely or principally with the machinery of heading 8425 to 8430, n.e.s. HSN Code 8438.

Learn MoreInjector sleeve hs code - vrqoy.spacelighting.shop

0401 - 0410. Dairy produce; birds' eggs; natural honey; edible products of animal origin, not elsewhere specified or included. 5. 0501 - 0511.

Learn More

Leave A Reply