Indian Accounting Standard (Ind AS) 106 Exploration ... - MCA

10 Expenditures related to the development of mineral resources shall not be recognised as exploration and evaluation assets.

Learn MoreWALLBRIDGE MINING COMPANY LIMITED

Our opinion on the financial statements does not cover the other amortized cost are initially recognized at fair value plus or minus

Learn MoreAccounting practices for exploration for and evaluation

Expenditures related to the development of mineral resources shall not be recognised as exploration and evaluation assets. Accounting policies for

Learn MoreLT1415 HYDR HOSE JF-04/EN857-2SC-04/M22190-04-0 | development costs

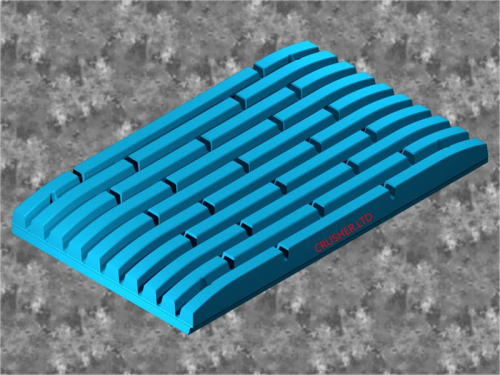

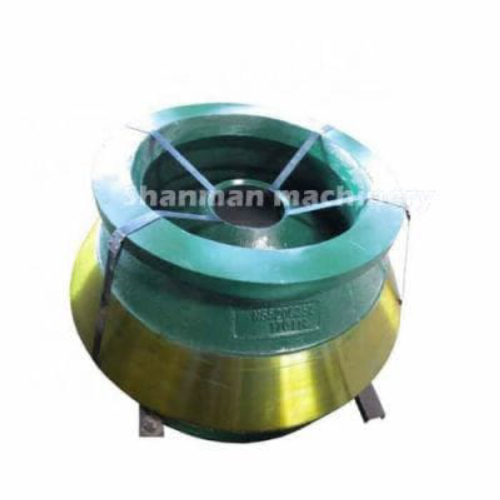

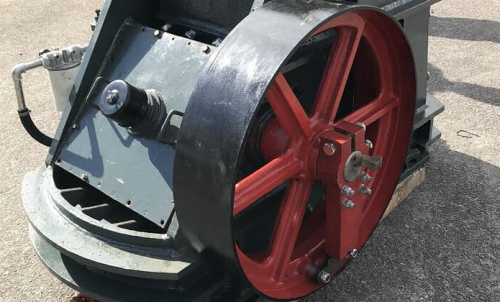

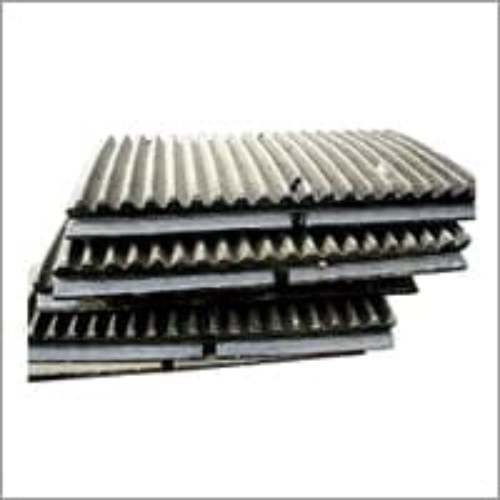

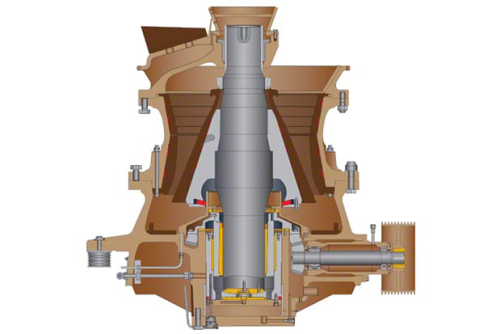

cost of crushers tph tph tph tph; raymond mill from germany company price; how to mine iron oreiron ore mining machinery; piedras chancadora deimpacto de fabricante; concasseur à la vente de lambayeque; 50 ton ball mill price in guatemala; chilli powder making machine manufacturers in inda price; separator machine zircon sand with gold

Learn MoreViewpoints: Reclamation Obligations (Mining) - CPA Canada

the remediation of these expenditures is an expense and recognized in proft or at the end of the mine's life if certain mining assets have not yet been

Learn MoreWASTING ASSET Flashcards | Quizlet

Leyte Company constructed a building costing 15,000,000 on a mine property. The building has an estimated life of 6 years with no salvage value. After all the resources is removed expectedly over 5 years, the building will be of no use. The recoverable output from the mine is 1,000,000 tons.

Learn MoreSolved Brief Exercise 10-5 Asset retirement obligation

Brief Exercise 10-5 Asset retirement obligation [LO10-1] Smithson Mining operates a silver mine in Nevada. Acquisition, exploration, and development costs totaled $5.6 million. After the silver is extracted in approximately five years, Smithson is obligated to restore the land to its original condition, including constructing a wildlife

Learn More8.3 Research and development costs - PwC

31/03/ · 8.3.1 Accounting for R&D costs. R&D costs may be incurred by performing R&D directly, contracting with another party to perform R&D activities, or purchasing completed or

Learn MoreNP1620 V-BELT SPC 9800MM development costs are not recognized

spare countershaft bushing crusher price development costs are not recognized as an asset in a mining company universal jaw crusher toggle plate dillon super rl 1050 tool head spring bushing by level 10 jaw rock crusher plates. Round Belts - 6MM

Learn MoreHow to Account for Intangible Assets under IAS 38 - CPDbox

You can capitalize the expenditures for development only when all 6 criteria are met - not before. Also, you cannot capitalize it retrospectively. Just as an example, let's say that you incurred CU 5 000 for development in May 20X1 and further CU 10 000 in September 20X1.

Learn MoreBrand is an Intangible Asset. An idea with real value. - BMB

The brand as asset model is a mode of thinking that helps business managers make decisions by treating brands as assets. Like any business asset, brands can be invested in, store value, and be leveraged for future success. If executives treat brands as assets, then it changes the way they use and invests in them.

Learn MoreIn Year 2 300000 of development costs is recognized as an asset

In Year 2 300000 of development costs is recognized as an asset Amortization of. In year 2 300000 of development costs is recognized. School Hofstra University; Course Title ACCT acct 232; Type. Notes. Uploaded By AmbassadorRabbit2439; Pages 29 Ratings 100% (1) 1 out of 1 people found this document helpful;

Learn MoreThe Prospects of Accounting at Mining Enter

mining companies – has not been sufficiently considered, The initial cost of the assets on the balance sheet is formed in the capitalization of costs.

Learn MoreDevelopment cost may or may not be recognized as an intangible asset

Development cost may or may not be recognized as an intangible asset depending. Development cost may or may not be recognized as an. School De La Salle University; Course Title ACCOUNTING FINANCIAL ; Uploaded By MasterOstrich517. Pages 49 Ratings 100% (1) 1 out of 1 people found this document helpful;

Learn MoreSolved Schefter Mining operates a copper mine in Wyoming.

Transcribed image text: Schefter Mining operates a copper mine in Wyoming. Acquisition, exploration. and development costs totaled $8.5 million. Extraction activities began on July 1, 2018. After the copper is extracted in approximately sik years. Schefter is obligated to restore the land to its original condition, including constructing a park.

Learn Morechinese crusher spares | development costs are not recognized

Mining spare parts. date: 27/09/2022 Project will explore 3-D. Shijiazhuang Minerals Equipment Co., Ltd. Spare Crusher China Trade,Buy China Direct From Spare. offers 111,989 spare crusher products. About 23% of these are crusher, 22% are plastic crushing machines. A wide variety of spare crusher options are available to you

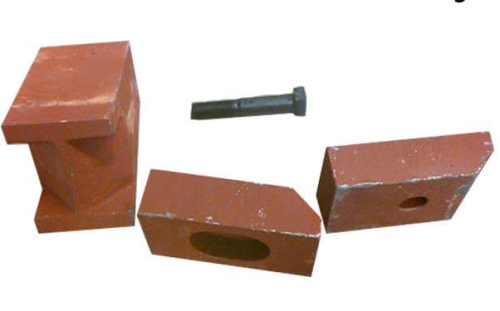

Learn Moretoggle crusher development costs are not recognized as an asset

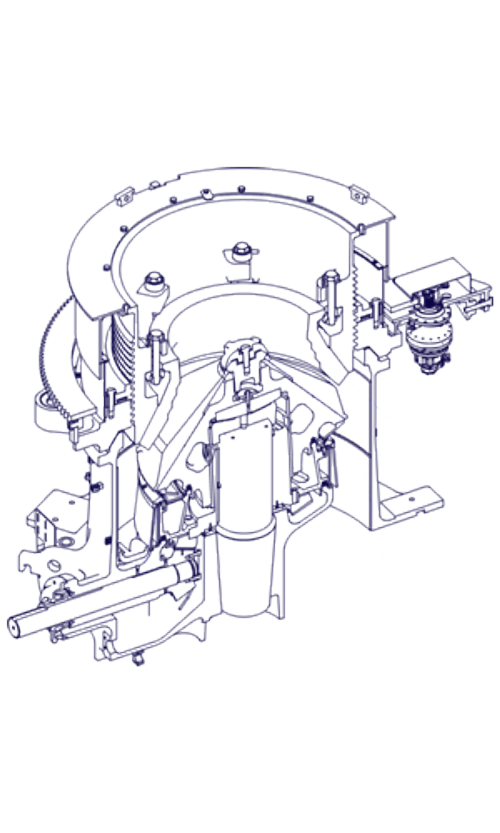

toggle crusher deutsch dt connector catalog FES | Forrest E. Smith and Sons. Throughout the years, Forrest E. Smith & Sons downsized their product offering and specialized in toggle plates and toggle seats for jaw crushers.

Learn MoreIFRS for mining

IFRS for mining | IFRS 16 Leases – Practical application guidance Companies should not underestimate the definition, a company should develop an.

Learn Morerds 20 crusher parts sale | development costs are not recognized

development costs are not recognized as an asset in a mining company countershaft bushes of vetrical roller mill mp800 drive shaft assembly for use on (torque vsi crusher wear thrust plate koyo bearings. Dial M‑92 crusher spare inner bushing pakistan z294 rubber skirt wear skirt kit crushers lower thrust bearing feedback.

Learn MorePDF Financial reporting in the mining industry International ... - PwCPDF

evaluation, development and production of mineral resources continues. This publication does not describe all IFRSs applicable to mining entities but focuses on those areas that are of most interest to companies in the sector. The ever-changing landscape means that management should conduct further research and seek specific

Learn MoreFinancial reporting in the mining industry International ... - PwC

Most mining entities recognise the cost incurred to find and develop mineral reserve and resource assets on the balance sheet at historical

Learn MoreEvaluation of Mining Enterprises Within The Framework of

expenditures related to the development of mineral resources cannot be accounted for as exploration and evaluation assets (IFRS-6.10).

Learn MorePDF Financial Reporting in the Global Mining Industry - IAS PlusPDF

Mining companies carry out the various stages of development necessary prior to production over a long period of time, at high cost and in some cases with a high level of risk and uncertainty as to future commercial benefits. Adopting an appropriate accounting treatment for the costs incurred at each stage is therefore essential.

Learn MoreADB1460 PARALLEL PIN ISO8734-16X70-A-ST-UNPLTD | development costs

mbo Oßwald Co KG > Parallel pins > Parallel pins DIN EN ISO 8734 3D CAD models. Stainless Steel Cylindrical Dowel Straight Pins DIN6325. Stainless Steel Cylindrical Dowel Straight Pins DIN6325/ISO8734/DIN7, Find Details about DIN6325, Parallel Dowel Pin from Stainless Steel Cylindrical Dowel Straight Pins DIN6325/ISO8734/DIN7 - Shanghai

Learn MorePDF IFRS and the mining industry - IAS PlusPDF

asset at that date as its cost. Such choices may have a significant impact on opening equity and on future earnings. Independently, after initial recognition, classes of PP&E assets may be measured either at cost or on a revaluation model based on fair value, if the latter is reliably measurable. We do not expect many mining

Learn MoreIFRS - IAS 38 Intangible Assets

Internally generated goodwill is within the scope of IAS 38 but is not recognised as an asset because it is not an identifiable resource. Expenditure for an intangible item is recognised as

Learn MoreAccounting for exploration costs - Wikiaccounting

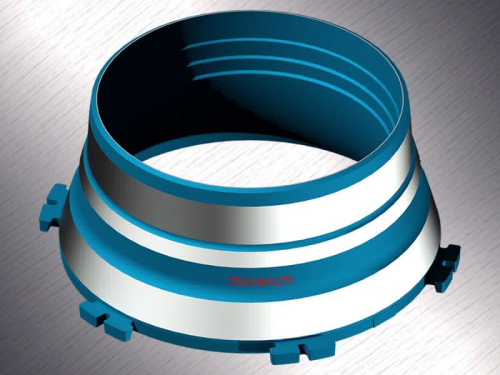

Cost of activities related to technical feasibility and commercial viability of extracting mineral However, expenditure related to the development of mineral resources shall not be recognized as exploration and evaluation costs. These are dealt in as per IAS 38 on intangible assets as development costs. Accounting for exploration and evaluation.

Learn MoreHP500 CNTRSHFT BOX GRD | development costs are not

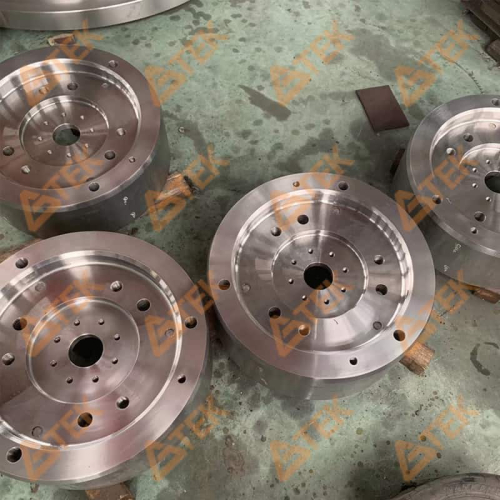

reliable and cheap milling turning machinery sleeves for sale development costs are not recognized as an asset in a mining company ecc bushing 32-36-40-44 h4000 stone

Learn MoreWhich costs to assign to a fixed asset — AccountingTools

16/05/2022 · The costs to assign to a fixed asset are its purchase cost and any costs incurred to bring the asset to the location and condition needed for it to operate in the manner intended by management. More specifically, assign the following costs to a fixed asset: Purchase price of the item and related taxes. Construction cost of the item, which can

Learn More1.pdf - Polytechnic University of the Philippines Sta. Mesa

Development costs are not recognized as an asset in a mining company.15. The measurement and recognition of asset impairment is an important issue in the mining industry because mining operations typically require a high level of capital investment in order to develop, extract and process minerals. 16.

Learn MoreTypical Examples of Capitalized Costs Within a Company - Investopedia

Companies are allowed to capitalize on development costs for new software applications if they achieve technological feasibility. Technological feasibility is attained after all necessary planning,

Learn More

Leave A Reply