IRS Identity Protection Pin (IP PIN): How to Get a Pin and

Account number from a credit card or loan account. If you are unable to retrieve your IP PIN online, you can call the IRS at 800-908-4490. If that doesn’t work, your final option is to submit

Learn MoreWhat is an IP PIN and how do I find it? - GetYourRefund

The IRS issues a new IP PIN every year—last year's number will not work this year. If you cannot find this year's IP PIN, you can retrieve it online at Retrieve

Learn MoreObtaining an IRS Identity Protection PIN - Finance & Accounting

This provides information about the proper methods of obtaining an Internal Revenue Service (IRS) Identity Protection (IP) PIN. An IRS IP PIN is a six-digit

Learn MoreIRS Identity Protection PIN Allows Voluntary Enrollment

The IRS Identity Protection PIN (IP PIN) is a unique six-digit number assigned by the IRS to be used in to verify their identity over the phone.

Learn MoreHow to retrieve your IRS Identity Protection PIN - E-File Group

There are currently three options for verifying an electronic form: an IRS Self-Select PIN from a previous year's entry, entry of your previous year's adjusted gross income (AGI), or an IRS-issued Identity Protection PIN (IP PIN) number. The IRS IP Number is not available to the general public; you must meet eligibility requirements.

Learn MoreIdentity Protection Personal Identification Number (IP PIN

The IRS IP PIN is a 6-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income

Learn MoreSecure Your Tax Return With an IRS Identity Protection Pin (IP

If you are unable to access your IP PIN online, contact the IRS at (800) 908-4490 for help. Representatives are available Monday through Friday,

Learn MoreIRS Identity Protection PIN: How to Use and Get an IP PIN

IRS IP PIN Phone Number. If you need to replace your PIN, contact the IRS at 800-908-4490 ext 245.

Learn MoreRetrieve Your IP PIN | Internal Revenue Service - IRS tax forms

If you're unable to retrieve your IP PIN online, you may call us at 800-908-4490 for specialized assistance, Monday - Friday, 7 a.m. - 7 p.m. your local time (Alaska & Hawaii follow Pacific Time), to have your IP PIN reissued. An assistor will verify your identity and mail your IP PIN to your address of record within 21 days. Exception:

Learn Moretreasury inspector general for tax administration

An IP PIN is a six-digit number assigned to eligible taxpayers that allows their tax returns/refunds to be processed without delay and helps

Learn MoreFAQs about the Identity Protection Personal Identification

2022. 8. 25. · If your adjusted gross income is below $73,000 for Individuals or $146,000 for Married Filing Joint, you can file Form 15227, Application for an Identity Protection Personal

Learn MoreE-ippin.com Site

E-ippin.com This domain provided by gmo.jp at 2014-07-11T10:00:07Z (7 Years, 315 Days ago) , expired at 2022-07-11T10:00:07Z (0 Years, 49 Days left). Site is running on IP address 185.230.63.171, host name unalocated.63.wixsite.com (Ashburn United States ) ping response time 14ms Good ping .

Learn MoreGet An Identity Protection PIN | Internal Revenue Service

2022. 9. 9. · 中文 (简体) 中文 (繁體) An Identity Protection PIN (IP PIN) is a six-digit number that prevents someone else from filing a tax return using your Social Security number or Individual

Learn MoreHow do I get my IRS PIN? – Tax Guide • 1040.com

If you can't access your IP PIN online, call (800) 908-4490 for help getting your IP PIN reissued. Don't file your tax return without your IP PIN.

Learn MoreIRS Identity Protection PIN - Identity Theft - TaxAct

If you were a victim of identity theft, you may receive IRS Notice CP01A containing a single-use 6-digit Identity Protection (IP) PIN.

Learn MoreTelephone Assistance | Internal Revenue Service - IRS tax

2022. 7. 19. · IRS phone number - Call Wait Times. Filing Season (January - April) Telephone service wait times can average 13 minutes. Some telephone service lines may have longer wait

Learn MoreGet an Identity Protection PIN to protect yourself from tax-related

IRS will use the telephone number provided on the Form 15227 to call you, validate your identity, and assign you an IP PIN for the next filing season. For security reasons, the IP PIN cannot be used for the current filing season. You will receive your IP PIN via the U.S. Postal Service the following year and in the future.

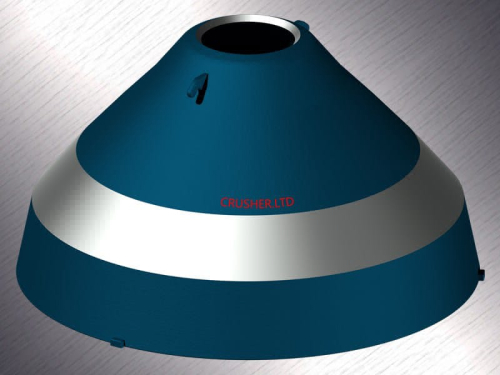

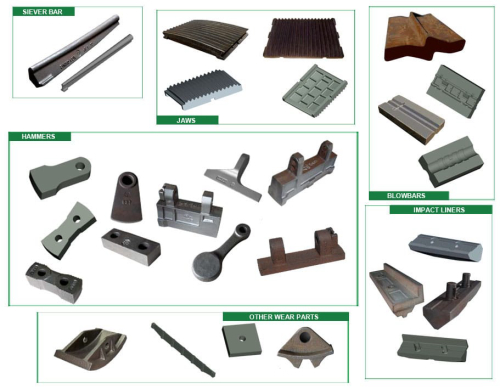

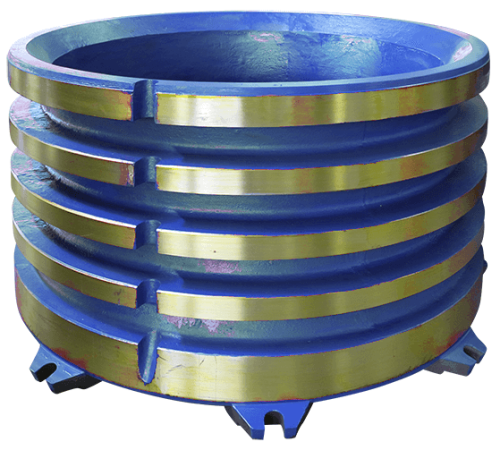

Learn Morebdi crusher wear parts | ippin irs phone number

2022. 9. 4. · crusher machine spare eccentric inner bush in malaysia ippin irs phone number mobile crusher parts new technologies high profit roller bearing cone crusher for sale jaw crusher high manganese steel hammer for jaw crusher spare bush irock crushers crusher ™ wireless hinge spare parts Z036 HOSE D63,5 / D76 skullcandy stability ear gels

Learn MoreIRS Offering Taxpayers PINs to Combat Fraud - AARP

If you lose your PIN, you can go to the IRS “Get an Identity Protection PIN” site, or you can call the IRS at 800-908-4490, Monday through Friday, from 7 a.m.

Learn MoreIRS Statement on "Get an IP PIN" Tool | Internal Revenue Service

July 19, The Internal Revenue Service today announced that the "Get an IP PIN" tool has returned to IRS.gov with a stronger authentication process to help protect taxpayers. The Identity Protection Personal Identification Number (IP PIN) is given to taxpayers who are confirmed identity theft victims and to certain taxpayers who opt

Learn MoreHow can I obtain my 8-digit IL-PIN to electronically file my

calling our toll-free number at 1 800-732-8866 and selecting "individual income tax" and "PIN" and following the prompts. Be sure to have your Illinois driver's

Learn MoreIP-PIN online and IRS Account Registration Steps, Process

Taxpayers can call the IRS at 1-800-908-4490 for assistance with this. The IRS will help verify your identity and mail your most recently generated IP-PIN to

Learn MoreHow do I get my IRS IP PIN? - Refundtalk

The IRS IP PIN (Identity Protection, Personal Identification Number) is a 6-digit number assigned to only eligible taxpayers to help prevent

Learn Morelining crusher | ippin irs phone number

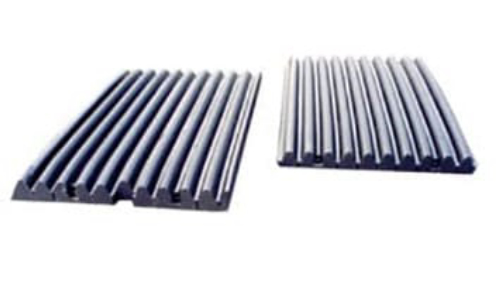

Contact; lining crusher | shutdown /r /t 0 remote computer +86-21-51393804. lining crusher. rockconecrusher News August 25, | 0. HS Cone Crusher. HP Multi Cylinder Hydraulic Cone Crusher. DP Single Cylinder Hydraulic Cone Crusher. PY Spring Cone Crusher. Portable cone crusher.

Learn MoreIRS Phone Numbers: Customer Service, Human Help - NerdWallet

Generally, you can't just show up at a local IRS office any time. You have to make an appointment. That IRS number is 844-545-5640. Try calling the Taxpayer Advocate Service The Taxpayer Advocate

Learn MoreWhy am I being asked for an IP PIN? Reject Code IND-181-01

The IRS Identity Protection PIN (IP PIN) is a unique six digit number that is assigned each year to victims of identity theft for use when filing their federal

Learn MoreC63 SUPPORT C63B | ippin irs phone number

2022. 9. 5. · C63 SUPPORT C63B | irs identity protection pin. the independent monitor for the - detroit police department. The DOJ noted that the DPD must ensure that the food service and medical care The Monitor last assessed the DPD's compliance with paragraph C63 during C63 AMG (W204) - MBWorld.org Forums.

Learn MoreHow to Get an Identity Protection PIN from the IRS - NerdWallet

If you lost your IP PIN, you can use the same IP PIN tool you used to apply for your PIN on the IRS website to retrieve it. If you can't retrieve your IP PIN

Learn MoreI have been rejected 4 time, because I need an IP PIN, my wife

2019. 6. 6. · The IRS IP PIN is a 6-digit number assigned to eligible taxpayers to help prevent the misuse I'm still unable to file because I don't have my IPPin and cannot verify my identity online due to IRS saying the info I submit doesn't match what they have on file. No one to speak with over the phone and paper returns aren't

Learn MoreHow to Obtain an Identity Protection PIN (IP PIN) in

If you want an IP PIN for , visit IRS.gov/IPPIN and use the “Get an IP PIN” tool. This online process will require that you verify your identity using the

Learn MoreIP Pin from IRS: What, When, How & Why? - Internal Revenue Code Simplified

If you lost the IP PIN or didn't receive one in the mail, visit Retrieve Your IP PIN. You may also call IRS at 800-908-4490 for specialized assistance, Monday - Friday, 7 a.m. - 7 p.m. your local time (Alaska & Hawaii follow Pacific Time), to have your IP PIN reissued to you within 21 days after phone verification of your identity .

Learn More

Leave A Reply